Technology has been at the forefront of driving the change in all the industries and more so in the Insurance industry. With the evolution of the next-gen technologies Usage-Based Insurance (UBI) has been in the forefront of changing the Auto Insurance market.

Technology has been at the forefront of driving the change in all the industries and more so in the Insurance industry. With the evolution of the next-gen technologies Usage-Based Insurance (UBI) has been in the forefront of changing the Auto Insurance market.

UBI is present in the market for quite a few years now, but the usage-based insurance market is relatively niche. However, the COVID-19 outbreak has disrupted the entire automotive industry and according to various insurance organizations/institutes, the COVID-19 pandemic gave a boost to the UBI industry. For example, according to Insurance Information Institute (iii), US witnessed a strong boost as vehicle owners did not want to pay full automotive insurance premiums. Usage Based Insurance is always a better deal than the Traditional Insurance for drivers who are driving less mileage and safely.

During pandemic, when people were in self-quarantine driving across the world had dropped significantly. This situation created a new trend of insurance carriers offering refunds to their policyholders specially in the US market. This is one of the key reasons for Insurers to focus more on the usage based insurance and invest on the technology to provide UBI to its customers. This created a win-win situation for both the Insurer and Insured and hence boosted the UBI market.

To summarize, customers are challenging the concept of giving flat rates for their auto insurance and rather have the Insurer personalize the rate based on their driving behaviour.

What is UBI – Usage Based Insurance

Usage-based insurance (UBI), also referred to as pay-per-mile, pay-as-you-drive or pay-how-you-drive, is a type of auto insurance where the cost or premium is dependent on the specific insurer’s driving pattern. Usage based Insurance depends on different parameters like speeding, sudden acceleration, hard brakes, even the time of the day of the drive.

Types of Usage-Based Insurance:

- Pay-as-you-drive: The policy premium is dependent on the number of miles/kilometres driven during the given policy period. It does not consider the style of driving behaviour.

- Pay-how-you-drive: Driving behaviour (i.e. the driving pattern – safe driver or rash driver) is the key factor in deciding the policy premium.

How does UBI work

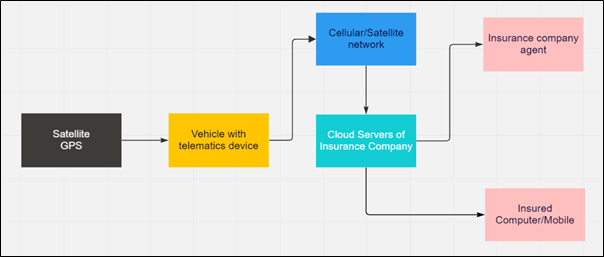

The insurance carriers collect the Telematics data from the vehicle. This facilitates the End-to-End communication between the device and the server that collects the data about the driving of the car. Additionally, the geographical data is collected via the GPS and then maps the driving behaviour to the terrain, weather conditions and the time of the day. The data is transmitted from that vehicle to other software and hardware systems using digital cellular/satellite networks. These data are aggregated, harvested, and derived into an accurate driving pattern and the risk profile for the driver which can be viewed by the Insurance company and also by the Policyholder in the web or mobile apps.

The data collected through telematics comprise mostly of the following information about the driving behaviour:

- Location

- Trip distance

- Time of the day

- Speed

- Harsh braking

- Cornering

- Seat belt use

- Fuel consumption

- Vehicle faults

- Engine data

- Idle time

- Use of Phone while driving

The telematics data can be collected in the following ways depending on the technology used by the insurance company:

- Onboard Diagnostics device attached to the Vehicle – The OBD devices are plugged into the car and directly sends the data to the server

- SmartPhone data collection through app – Inexpensive and no installation cost

- By using a device with Bluetooth-enabled beacon mounted on the dashboard or windshield – This Bluetooth device sends the driving data directly to the server or connected via smartphone

- Black Box – This electronic device is securely placed inside a car and send the accurate data directly to the server

- OEM Data collection – Data is collected through already built-in systems in the vehicle. It eliminates the need for installing telematics devices separately

Traditional Insurance vs Usage Based Insurance

Traditional car insurance use factors such as age, driving record, credit history, years of driving experience etc. to determine the premium. Usage based Insurance considers the driving habits for calculating the premiums.

The fundamental difference between the traditional and usage-based insurance is that traditional insurance takes into account the reflection of historical information of the driver while UBI considers the present patterns of driving behaviour.

Hence the traditional insurance companies are changing their strategies based on the current market scenario due to the demand from the new-age insurers. They are adapting and integrating technology to bring in UBI to ensure that policyholders get the best available policy.

|

Usage Based Insurance |

Traditional Insurance |

|

|

|

|

|

|

Advantages of Usage Based Insurance

UBI has a lot of benefits over the traditional insurance models and hence gradually becoming the primary mode of insurance.

Some of the key benefits of UBI are as follows –

- Since UBI records the driving data it creates awareness among the drivers and in turn help them improve driving habits

- Improvement in the driving habit reduces the number of accidents on roads and increases road safety

- UBI provides the opportunity in the hands of the driver to decide the premium they want to pay. If they drive safely, they can pay lesser premium and rash driving leads to payment of higher premium

- UBI reduces the claim costs since there are fewer road accidents due to general improvement in driving behaviour

- The data collected from telematics device help in quicker claim settlement

- The policyholders who do not use their vehicle frequently will have to pay less premium compared to the premium for traditional policies

- Improving customer satisfaction since the safe drivers will be able to save money on insurance premiums and invest it elsewhere

Why are some drivers not comfortable in adopting UBI

Usage-based insurance business model requires the driving pattern being recorded. Not everyone is comfortable in sharing the continuous driving feed to the insurance companies, especially when the UBI telematics device tracks every movement. This creates privacy concerns among many drivers. How this driving data is used or shared by the insurance companies is one of the top concerns among the drivers.

Some of the telematics devices are costly, and installation of the external devices increases the overall cost for UBI. Policyholders might not be comfortable bearing these extra charges.

Also, it becomes difficult for the drivers to compare between the insurance companies before choosing the final insurer.

Guidewire Usage Based Insurance Solution

Guidewire has brought the Guidewire End to End UBI solution as part of Cortina Release. Guidewire UBI solution is feature which uses the Guidewire Insurance suite as the base application and it is built on the Guidewire Cloud Infrastructure.

Guidewire UBI solution uses telematics to collect information about the driving pattern. The telematics device/app installed in the vehicle continuously collects the data about driving behaviour and other parameters required for UBI. The real time data is sent to Guidewire. This data received from the telematics device is integrated to the Underwriting workflow. Guidewire aggregates the data and use predictive analytics to generate the driver specific risk score.

Guidewire UBI is pre-integrated with certain telematics providers, but it is not limited to only those partners. GW UBI supports any telematics provider the Insurance company wants to partner with.

The relevant telematics data and risk score is fed to Guidewire PolicyCenter and Guidewire BillingCenter through the GW Integration framework. GW PolicyCenter takes the data received to track and price each trip based on the score from the different parameters like distance, duration, hard braking etc. Policyholders can view their trips at anytime and improve their driving behaviour to improve their score and reduce premiums.

Guidewire End-to-End UBI solution has also eased up the Claim process. After an accident the policyholders can document the damage and upload the photo of damaged vehicles through the application of the insurer. Guidewire ClaimCenter receives these documents and uses the relevant telematics data to automatically create a claim for the policyholder. All the necessary information about the crash data like date, time, speed of vehicle etc., required to create a claim are prefilled without any human interference. This has reduced the time required for claim processing by a large extent.

The solutioning also allows the policyholders with traditional insurance to shift to UBI just by doing an endorsement.

Benefits of Guidewire UBI solution

Key benefits of using the Guidewire UBI solution: –

- Guidewire UBI solution provides End to End Insurance lifecycle support right from New Business, Endorsement change, Rewrite, Renewal etc.

- The solution is built on the Guidewire Cloud – the primary advantage being the insurance company can bring the product quicker to the market and gain competitive advantage over others

- GW UBI already has preconfigured integration set up with partners such as the telematics providers

Duck Creek Telematics-Based Insurance Solution

Duck Creek has immense experience in insurance solutioning, and it has helped them to provide the platform for telematics-based solution. Duck Creek solutions are available standalone or as a full suit as per the requirements of the insurance carrier. Duck Creek already has the existing unified suite of insurance software products comprising of Policy, Billing, Claims, Rating etc. Their advanced technologies are designed to accommodate any changes in the market which allows insurance carriers to capture market opportunities.

Duck Creek has Integration packages ready with different telematics partners and it is provided to the users with an extension to Duck Creek’s Policy System. Through Duck Creek Anywhere and its robust set of APIs insurers can now seamlessly integrate the telematics solutions to their existing value stream. The package is designed to integrate a telematics program and risk profile with policy administration software quickly and cost effectively. It enables carriers the ability to incorporate behaviour-based driving information into the auto insurance.

Advantages of Duck Creek Telematics-Based Solution

The advantages of Duck Creek Telematics based solution are –

- Insurance carriers can accelerate the speed to the market with their telematics-based insurance products since they are integrating the telematics data to already existing Duck Creek insurance suit

Fecund and Usage based Insurance

Fecund provides software development and IT consultancy services to companies in the Insurance domain. Fecund strives to provide innovative solutions that impact the business and act as catalyst for its partners in bringing products faster to the market. Usage based insurance is one such solution. Fecund has prior experience in implementing Usage Based Insurance solutions for European and American clients in the Guidewire platform.

Conclusion

In the Auto Insurance sector, gradually it is becoming evident that the Usage Based Insurance market will continue to grow in future. The race between flat rate insurance and usage based insurance has already begun. It can be assumed that the demand for traditional insurance will diminish gradually and UBI will take the position as the major product in the car insurance market.

Insurance carriers are already investing heavily, if not already invested, on the technology upgradation to support usage-based motor insurance. Developed Insurance markets are well advanced in adopting this product. Evolving markets are also catching up to this technology advancement.

However, Insurance carriers should be mindful of the customer prejudices. They should also need to invest in data storage and privacy to address any concerns from potential customers.

Author: Rupam Mukherjee

Rupam Mukherjee is a Senior Business Analyst with 6+ years of experience in the IT industry in software implementation. He has rich experience in the P&C Insurance domain working on products like Guidewire and SmartCOMM. Proficient in Requirement Elicitation, Gap Analysis, Estimation, Business Process Modelling, Impact Analysis, Agile Methodology, Functional Specification documentation. Successfully delivered multiple projects from Inception to Go live. His continuous commitment and passion for innovation, simplicity, and attention to detail with strong analytical and interpersonal skills have resulted in delivering various projects simultaneously and achieving timely results.

LinkedIn Profile

Post a comment