Elysian is the latest version of the Guidewire cloud release. Guidewire brought its cloud-based platform GWCP back in 2019 and gradually improved the cloud platform in the versions namely Aspen, Banff, Cortina, and Dobson. Elysian is the fifth and most recent release by Guidewire.

Elysian is the latest version of the Guidewire cloud release. Guidewire brought its cloud-based platform GWCP back in 2019 and gradually improved the cloud platform in the versions namely Aspen, Banff, Cortina, and Dobson. Elysian is the fifth and most recent release by Guidewire.

Guidewire Cloud Platform

- Latest features of GWCP –

- In the Elysian launch, we get an improved and dynamic GWCP platform with a dashboard and metrics containing all the operational data of the customer. This data is updated dynamically every 5 seconds. The Application performance management (APM) makes it easier for carriers to troubleshoot any GW performance issues in production

- Advanced Product Designer – Always the most essential part of GW implementation – Now GW has extended the use of Advanced Product Designer (APD) for ClaimCenter implementation to create the claim data model and FNOL screen. APD is used to visualize the data model that supports the entire insurance lifecycle, simplifying configuration and helping the carriers to launch the products even faster to the market.

- Integration Gateway – Integration Gateway has the comprehensive integration logic from the Insurance Suite which reduces the complexity and improves the developer efficiency. It allows customers and partners to deliver integrations faster at a reduced cost. The 400+ Cloud APIs and 200+ Edge APIs in which helps to integrate the core GW applications with the external systems.

- Cloud Data Access (CDA) – Provide access to real-time data in the cloud. GW data studio is used to customize and consume the data as per the client’s needs

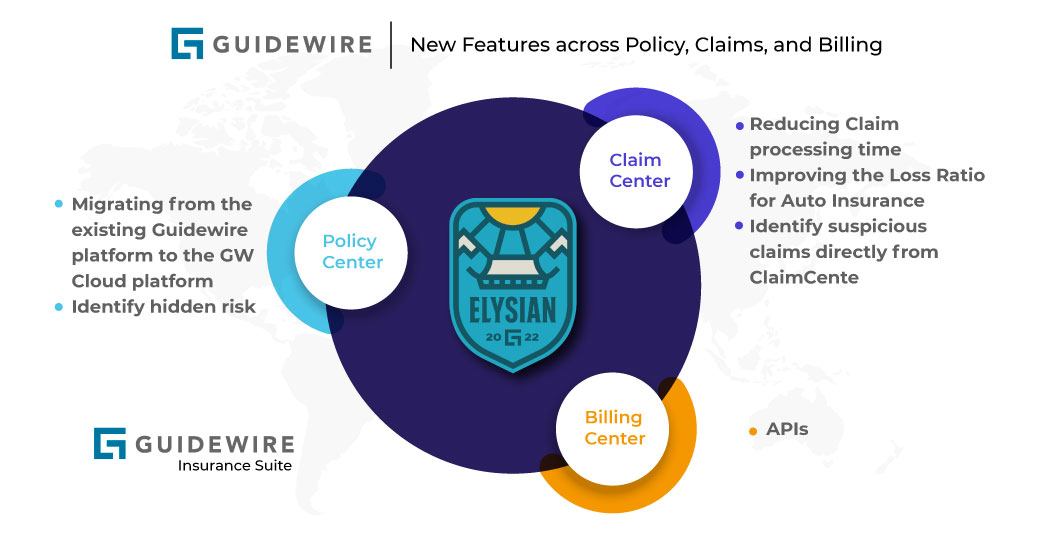

New features across Policy, Claims, and Billing

Claims

a) Reducing Claim processing time – In ClaimCenter Supervisors will now have the ability to preapprove multiple payments which in turn reduces the time taken by adjusters to get approval each time they want to make a payment.

b) Improving the Loss Ratio for Auto Insurance – Collision & Subrogation Scoring is a new feature brought in this release. This is a numeric score generated based on various factors like Vehicle age, Loss cause, etc. There will be alerts created for the adjuster based on the score. This will reduce the manual referral to adjuster and in turn improve the auto loss ratio.

c) Identify suspicious claims directly from ClaimCenter – This feature is created for Weather Discrepancy alerts. Weather data is collected from third-party sources. The weather data is compared against the loss cause of any claim when the claim is created or updated. In case of discrepancy, an alert is created for the adjuster for further investigation. Guidewire also provides the feature for the adjusters to identify any severe weather events near the location of the claim.

Policy

a) Migrating from the existing Guidewire platform to the GW Cloud platform – Elysian brings in the new feature where Advanced Product Designer(APD) can be used to create Cloud API, metadata, and APP events from the existing product in the guidewire platform.

b) Identify hidden risk – HazardHub provides an extensive set of property risk factors. In this launch, GW focus is on improving the risk selection using the permit dataset in HazardHub. All the data regarding any changes to the property is available in the permit data for all the US states. This improves the risk and pricing of these risk factors for the insurance carriers.

Billing

a) APIs – Elisyian has the first set of APIs with endpoints to BillingCenter. There are two types of APIS. Common APIs connect to activities, documents, typelists, and Admin APIs allow the billing plans, and delinquency plans.

Markets and Line of Business specific Updates

- Guidewire GO – GO is a library with different products specific to country and line of business requirements which accelerates the new product design process. New market-specific products are launched for different regions around the globe. Examples like – InsuranceNow Go Farmowners are designed specifically to make the implementation of Farmowners LOB easier and faster. Also, AAIS Commercial Inland Marine products for insurers in North America have been launched.

Other region-specific updates are as follows:

- Australia – Specific Products for Personal Motor and Workers Compensation for the Australian market have been launched. They have the features like regional address, currency, etc. which are very specific to the Australian market.

- London – Complex Commercial Product specific to the London market. This product has a tailor-made product model for the London market which has improved the flexibility to underwrite the risk in this market. It also has integrations for Accounting and messaging with Llyod’s and Company market.

- France – Claim processing has been improved with pre-built integrations with bodies like IRSA and IRCA. Reduction in the claim processing time with of bodily injury through easier claim allocation and payments.

- Embedded Insurance – Guidewire has brought this end-to-end solution for embedded insurance. It handles the full policy lifecycle for embedded insurance right from the quote to the claim. PolicyCenter generates the Embedded Insurance APIs to integrate with the distribution channels as preferred by the business. Insurers can launch the Embedded Insurance in 12 weeks.

Guidewire Education’s Elysian courses will help you improve your knowledge of InsuranceSuite, Digital, and Data. Examine the new and updated training content that is now available. Click for More Information

Explore More about the Guidewire Elysian Release: https://www.guidewire.com/elysian/

Post a comment