How Technology Is Transforming the Insurance Industry

The world of constantly changing technology, Insurance industry is not untouched. Today’s insurance agents don’t operate in the same way that they did 20 years ago. Technology offers amazing new ways for agents to provide personalized, advanced service to community members.

This blog gives you a sneak peek at what you can expect technology to look like in the coming years and how it could affect the insurance industry

Omni-Channel CRM

In insurance, there are a lot of moving parts for every customer – lots of information that can impact a quote. Without a decent CRM system in place, it can be hard to maintain a single view of the customer or use it to close more business. That is why omni-channel Customer Relationship Management (CRM) is becoming a serious game-changer.

With omni-channel CRM, you can track and monitor ongoing customer interactions, contact Information, unresolved complaints or requests in one place; whether you interact with the customer online, on mobile, via social media or in person.

Telematics

Telematics combines computers and wireless technology to stream information across multiple platforms, which can then be used for analysis. Think of a Fitbit as a telematics device, and as someone burns calories or walks so many steps, it syncs that information to their phone, computer and tablet for them to look at and analyze in the future.

Insurers use telematics in a very similar way.

Automotive black boxes – or telematics – are not a new invention, but their use among Millennials is profound. Using GPS to record the handling of a car and the quality of driving, the smartphone-sized box reports back to insurers directly. Depending on the information they receive, drivers may benefit from anything up to a 20% drop in the price of premiums – or they may have to face further price hikes until their driving improves.

The reason the blackbox is particularly popular amongst young drivers, is because this age group is often penalized by having to pay higher insurance prices, because of age along. With telematics installed in their car, they can prove their driving is of a high standard and shave off hundreds from their renewals.

Big Data

There is data everywhere on policyholders. Simply going through someone’s Facebook page can reap an incredible amount of information. But, even though insurers aren’t likely to sift through anyone’s wall posts, there is a benefit to having a large amount of data stored on any given customer.

Insurance companies in the property and casualty field face a major opportunity as technology develops: they have more and more information on which to base their risk assessments. Internet-connected devices make it possible to gather more data than ever before about the state of property and its environment.

Self-Service Dashboards

We’ve seen it in grocery store lines and restaurants — and now we are finally seeing it in insurance. As we’ve learned, people want to use their phones to get “life” done as quickly and easily as possible. They’ve also started to get more comfortable with doing serious things — such as taking out mortgages and buying cars — at the click of a button. It makes sense they’d want to do the same thing with their insurance—managing everything from finding the right policy and making a claim, to tracking their car repair all from one place.

Customer friendly self-service can facilitate claim processing in regular insurance scenario while the special cases can be managed by agents or claim handlers.

Machine Learning

No matter whether it’s B2B or B2C, people are always looking for the best deal, especially when it comes to insurance. If another company provides a better quote, even loyal customers will jump ship. To combat this, insurance companies must do everything they can to provide the best for their customers. Enter machine learning.

With machine learning, insurance companies can move away from static datasets to something far more advanced that humans alone would be incapable of. Since insurance has always been data heavy, it is perfectly poised to be significantly impacted by Machine Learning.

Internet of Things

Gartner, Inc. forecasted that 6.4 billion connected things would be in use worldwide in 2016 and there will be as many as 20.8 billion by 2020. As more and more devices join the rapidly growing Internet of Things ecosystem, the opportunity for insurance companies to take advantage opens.The sheer volume of data that these devices provide is staggering, and if use in the right way it can revolutionize the way insurance companies produce quotes.

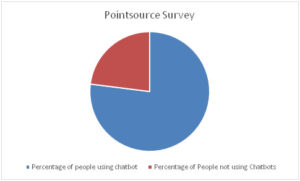

Chatbots

Chatbots are the new holy-grail of augmenting customer engagement and brand presence. They are proving to be very useful in most industries including the insurance industry. With the help of intuitive chatbots, insurance companies can explain complex products to their customers, drive brand engagement, and improve sales and distribution.

Few of the companies who have already implemented Chatbox are – NEXT Insurance, Lemonade, Trov, Bajaj Alliance General Insurance Co. Ltd., GEICO etc.

Emerging technologies and innovations are beginning to transform the insurance landscape as they enable new ways to measure, control, and price risk, engage with customers, reduce cost, improve efficiency, and expand insurability. This has produced enormous opportunities for established insurers to modernize, create new insurance products and services, and shake up their business models. It has also led to the emergence of many new innovative startups seeking to significantly enhance the way insurance has traditionally been assembled, purchased, and experienced.

Going forward, both competition and partnerships between tech-savvy incumbents and increasingly well-funded and nimble new market entrants are expected to rise. This will likely fuel further innovation and transformation within the industry. At the same time, addressing issues surrounding comprehensive data regulation will grow in importance, and insurance regulators and data privacy rules will play a significant role in determining how insurers will be able to use data and influence the level of product customization available to customers.

Post a comment