What is Predictive Analytics?

In simple terms, Predictive Analytics helps connect data to effective action by drawing reliable conclusions about current conditions and future events.

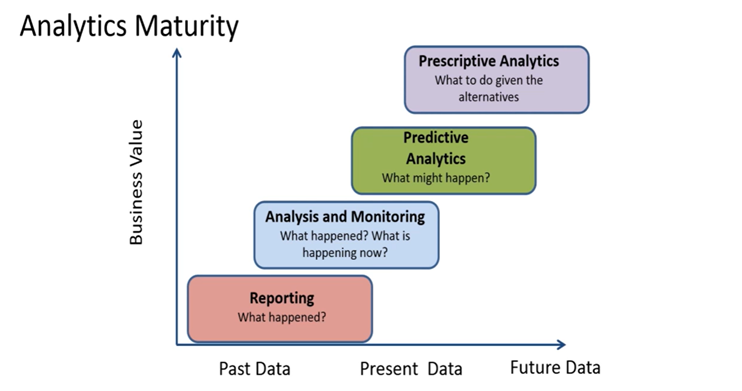

Reporting is all about what happened in the past a true rear-view analysis of your data.

Analysis and Monitoring tell about what happened and what is happening now this is leveraging present as well as your past data.

Predictive Analytics is on the next level where it will take your past, and present data to help predict what might happen in future

Perspective Analytics would be the next step of predictive analytics which would tell us the alternatives to be considered.

Role of Predictive Analytics in the Insurance Industry

Data is very important for the insurance business. Predictive Analytics provides effective tools and techniques to collect and access data. It enables them to use this data for better risk management and improve processes.

The rise of technology has helped the industry to study past data and by applying certain algorithms industries are trying to identify their risk segments. The data can thus be used to affect insurance underwriting, rating, pricing, forms, marketing, and claims management in the insurance industry.

- Fraud Detection and Prevention

Insurance companies in the United States lose more than $80 billion each year due to fraud. Such deception results in higher premiums for all stakeholders. Data analytics can be used to protect insurance companies from such fraud. By using predictive analytics, insurers can compare a person’s data to previous fraudulent profiles and identify cases that require further investigation.

- Risk Evaluation

The entire concept of insurance companies revolves around risk diversification. While assessing risks, insurers have always prioritized the verification of customer information. Based on their data, customers are classified into various risk classes. Big data technology has the potential to improve the overall efficiency of the risk assessment process. Before making a final decision, an insurance company can use big data and predictive modeling to anticipate potential issues based on client data and classify them accordingly.

- Cost Saving Using Insurance Analytics

One of the many advantages of leveraging technology is cost reduction. Machines’ increased role in the industry increases efficiency, which eventually leads to cost savings. Big data technology can be used to automate manual processes, increasing their efficiency and lowering the costs associated with handling claims and administration. This will enable the companies to offer lower premiums to their customers and thus stand out in a competitive market.

What is Guidewire Predictive Analytics?

Guidewire Predictive Analytics is an advanced P&C insurance-specific, machine-learning platform that empowers insurers to make smart data-driven decisions throughout the insurance lifecycle.

Guidewire analytics is a term used to describe a type of data analysis that is specifically designed for the insurance industry. It involves the use of advanced algorithms and tools to examine data related to insurance policies, claims, and other important factors that impact the industry.

At its core, guidewire analytics is all about helping insurance companies make better decisions based on data. By analysing patterns and trends in the data, companies can identify potential risks, uncover opportunities for growth, and improve overall performance.

There are many different types of data that can be analyzed using guidewire analytics. It can also be used to help companies manage risk by predicting the likelihood of specific events, such as natural disasters or cyberattacks.

To get started with guidewire analytics, companies typically need to have access to large amounts of data. This data can come from a variety of sources, including internal databases, external data providers, and social media platforms. Once the data has been gathered, it can be analyzed using a variety of tools and techniques, including machine learning, predictive modeling, and data visualization.

Guidewire Analytics typically involves the following steps:

Data collection and preparation: This involves collecting data from various sources, including the Guidewire platform, and preparing it for analysis.

Data analysis: This involves using statistical and analytical tools to analyze the data and identify trends, patterns, and insights.

Reporting and visualization: This involves presenting the results of the analysis in a clear and understandable format, using charts, graphs, and other visualizations.

Actionable insights: This involves using the insights gained from the analysis to make informed decisions and take action to improve the performance of the insurance company.

Guidewire Analytics can provide insurers with a range of benefits, including:

Improved customer experience: By analyzing customer data, insurers can gain insights into customer behavior and preferences, and use this information to tailor their products and services to better meet the needs of their customers.

Risk management: By analyzing claims data and other risk-related data, insurers can identify potential risks and take action to mitigate them, reducing the likelihood of costly claims.

Operational efficiency: By analyzing operational data, insurers can identify areas for improvement and take action to streamline processes and improve efficiency.

Performance tracking: By tracking key performance indicators (KPIs) such as revenue, claims volume, and customer satisfaction, insurers can monitor their performance and make data-driven decisions to improve their business outcomes.

Conclusion

Overall, guidewire analytics is a powerful tool that can help insurance companies improve their operations and gain a competitive edge. By leveraging data in new and innovative ways, companies can stay ahead of the curve and deliver better outcomes for their customers. The insurance industry is diversifying its products and services as demand grows by the day. It makes it more difficult for insurers to maintain a sustainable business model. To compete successfully, insurers must find ways to stay one step ahead of the competition. FECUND is a leading insurance IT professional service provider that helps property and casualty insurers transform into digital businesses. Our experienced team can help you to navigate your end-to-end Guidewire journey. We help P&C insurers to transform their business with disruptive technology.

Author Bio: Sravan Nakka is a Senior Guidewire Developer with 11 years of experience in the industry and 6+ years of relevant experience in GW software implementation. Worked across multiple US Insurance Clients and being a part of those crucial implementation right from the inception phase. He is a GW Specialist Certified and AINS 21.

Author Bio: Sravan Nakka is a Senior Guidewire Developer with 11 years of experience in the industry and 6+ years of relevant experience in GW software implementation. Worked across multiple US Insurance Clients and being a part of those crucial implementation right from the inception phase. He is a GW Specialist Certified and AINS 21.

Post a comment