As we progress deeper into the digital decade, insurance companies are under increasing pressure to innovate, streamline operations, and meet customer expectations faster than ever. Legacy core systems are no longer sufficient to compete in a cloud-first world—especially with rising demand for agility, cost-efficiency, and seamless customer experiences.

Enter Guidewire Cloud: a future-ready solution that is reshaping how property and casualty (P&C) insurers run their core operations. From faster product rollout to easier integrations and built-in security, Guidewire Cloud is becoming the preferred choice in 2025. If you’re still on the fence about making the move, this blog will walk you through why it’s the smartest decision this year.

-

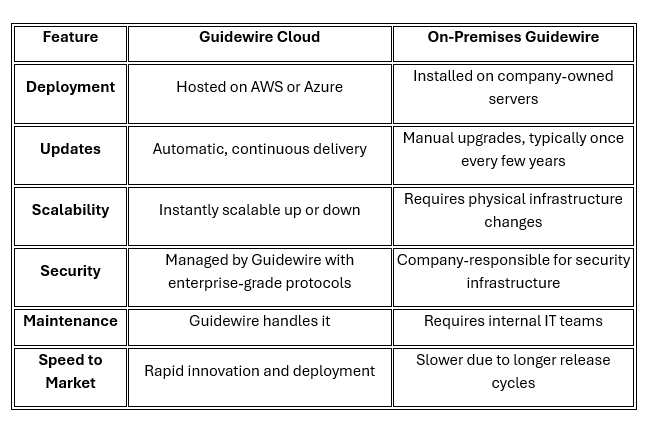

What Makes Guidewire Cloud Different from On-Premise Systems?

One of the most common questions among insurers considering modernization is the difference between Guidewire’s cloud-based platform and its traditional on-premise deployment. Here’s a clear comparison:

In essence, Guidewire Cloud minimizes IT complexity, lowers costs, and enables faster access to new features—all while maintaining robust security and performance standards.

-

Accelerated Speed to Market

In today’s fast-paced market, insurers must roll out products in weeks, not months. With Guidewire Cloud, organizations benefit from:

- Pre-built accelerators and APIs that reduce development time

- Continuous integration and delivery (CI/CD) pipelines that streamline releases

- Instant access to new features and updates as they become available

This agility enables insurers to test and launch new offerings, rating changes, or workflows quickly—without the delays often associated with legacy systems or custom patching.

The result? Insurers stay ahead of competitors and meet evolving customer needs faster.

-

Reduced IT Burden and Cost Efficiency

Guidewire Cloud significantly lightens the load for internal IT teams by offloading infrastructure management, upgrades, monitoring, and security responsibilities to Guidewire’s managed services.

- No more worrying about server capacity or unexpected downtime

- No more complex upgrade projects every 2–3 years

- Predictable operational costs with subscription-based pricing

This shift to a managed services model allows insurers to focus on core business functions rather than maintaining technology. Over time, this leads to substantial cost savings and better resource allocation.

-

Enhanced Security and Regulatory Compliance

With growing threats from cyberattacks and increasing regulatory requirements, security is a top concern for insurers. Guidewire Cloud offers:

- End-to-end encryption and secure data storage on trusted platforms like AWS and Microsoft Azure

- Regular penetration testing and 24/7 monitoring by security professionals

- Compliance with industry regulations such as GDPR, SOC 2, and NAIC cybersecurity guidelines

Guidewire’s cloud infrastructure is built with insurance-specific security needs in mind, ensuring peace of mind for insurers and their customers.

-

Access to a Modern Ecosystem and Innovation

Guidewire Cloud opens the doors to a vibrant ecosystem of pre-integrated insurtech partners, AI/ML tools, and real-time analytics platforms via the Guidewire Marketplace and APIs. This makes it easy for insurers to:

- Integrate third-party data providers and fraud detection systems

- Leverage machine learning for claims automation and underwriting decisions

- Deliver personalized digital experiences through modern frontend integrations

This “plug-and-play” approach to innovation keeps insurers future-ready and able to respond rapidly to emerging trends—whether it’s usage-based insurance, parametric claims, or embedded offerings.

Conclusion: Why Now Is the Right Time

The insurance industry is at a turning point. Cloud adoption is no longer a luxury or a long-term plan—it’s a necessity. Insurers that want to thrive in 2025 and beyond need core systems that are agile, secure, scalable, and cost-effective.

Guidewire Cloud offers exactly that.

By transitioning to the cloud, insurers not only unlock operational efficiency but also gain the tools and flexibility to innovate continuously and compete with both traditional players and agile insurtech startups.

Whether you’re modernizing claims, underwriting, policy administration, or billing—Guidewire Cloud empowers your transformation with speed, intelligence, and long-term value.

Check for the latest updates on our Guidewire Services, feel free to contact us at info@fecundservices.com!